Page 22 - HBiz_November_2024

P. 22

22 STATISTICS & ANALYSIS HOSPITALITY BIZ NOVEMBER, 2024

n

Occupancy and Room Rates Surge Amid

Robust Demand: HVS-ANAROCK

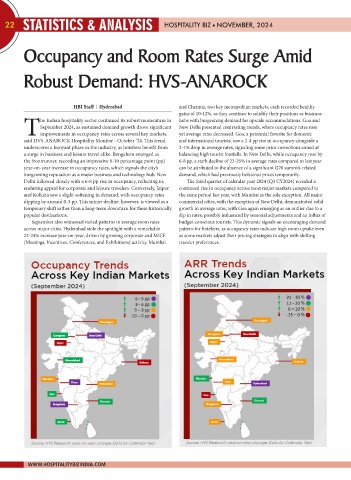

HBI Staff | Hyderabad and Chennai, two key metropolitan markets, each recorded healthy

gains of 10-12%, as they continue to solidify their positions as business

he Indian hospitality sector continued its robust momentum in hubs with burgeoning demand for upscale accommodations. Goa and

September 2024, as sustained demand growth drove significant New Delhi presented contrasting trends, where occupancy rates rose

Timprovements in occupancy rates across several key markets, yet average rates decreased. Goa, a perennial favorite for domestic

said HVS-ANAROCK Hospitality Monitor - October ‘24. This trend and international tourists, saw a 2-4 pp rise in occupancy alongside a

underscores a buoyant phase in the industry, as hoteliers benefit from 2-4% drop in average rates, signaling some price corrections aimed at

a surge in business and leisure travel alike. Bengaluru emerged as balancing high tourist footfalls. In New Delhi, while occupancy rose by

the frontrunner, recording an impressive 8-10 percentage point (pp) 6-8 pp, a stark decline of 23-25% in average rates compared to last year

year-on-year increase in occupancy rates, which signals the city’s can be attributed to the absence of a significant G20 summit-related

burgeoning reputation as a major business and technology hub. New demand, which had previously bolstered prices temporarily.

Delhi followed closely with a 6-8 pp rise in occupancy, reflecting its The third quarter of calendar year 2024 (Q3 CY2024) revealed a

enduring appeal for corporate and leisure travelers. Conversely, Jaipur continued rise in occupancy across most major markets compared to

and Kolkata saw a slight softening in demand, with occupancy rates the same period last year, with Mumbai as the sole exception. All major

dipping by around 0-3 pp. This minor decline, however, is viewed as a commercial cities, with the exception of New Delhi, demonstrated solid

temporary shift rather than a long-term downturn for these historically growth in average rates, with Goa again emerging as an outlier due to a

popular destinations. dip in rates, possibly influenced by seasonal adjustments and an influx of

September also witnessed varied patterns in average room rates budget-conscious tourists. This dynamic signals an encouraging demand

across major cities. Hyderabad stole the spotlight with a remarkable pattern for hoteliers, as occupancy rates indicate high room uptake even

22-24% increase year-on-year, driven by growing corporate and MICE as some markets adjust their pricing strategies to align with shifting

(Meetings, Incentives, Conferences, and Exhibitions) activity. Mumbai traveler preferences.

WWW.HOSPITALITYBIZINDIA.COM