Page 23 - HBiz_September_2024

P. 23

STATISTICS & ANALYSIS

HOSPITALITY BIZ SEPTEMBER, 2024 23

n

Hyderabad emerges as the RevPAR growth leader

in Q2 2024, registeres a growth of 11.9% : JLL

Hbi Staff | Hyderabad Hyderabad leading the list. Although occupancy levels

remained relatively stable in Q2 2024 compared to Q2 2023,

he hospitality sector continued to witness ADR levels improved, leading to an increase in RevPAR

Year-on-Year (YoY) growth in performance in across all markets, excluding Goa.

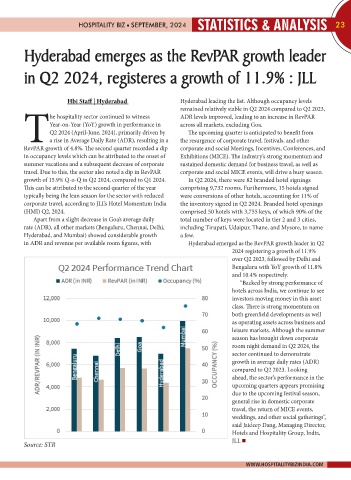

Q2 2024 (April-June, 2024), primarily driven by The upcoming quarter is anticipated to benefit from

Ta rise in Average Daily Rate (ADR), resulting in a the resurgence of corporate travel, festivals, and other

RevPAR growth of 4.8%. The second quarter recorded a dip corporate and social Meetings, Incentives, Conferences, and

in occupancy levels which can be attributed to the onset of Exhibitions (MICE). The industry’s strong momentum and

summer vacations and a subsequent decrease of corporate sustained domestic demand for business travel, as well as

travel. Due to this, the sector also noted a dip in RevPAR corporate and social MICE events, will drive a busy season.

growth of 15.9% Q-o-Q in Q2 2024, compared to Q1 2024. In Q2 2024, there were 82 branded hotel signings

This can be attributed to the second quarter of the year comprising 9,732 rooms. Furthermore, 15 hotels signed

typically being the lean season for the sector with reduced were conversions of other hotels, accounting for 11% of

corporate travel, according to JLL’s Hotel Momentum India the inventory signed in Q2 2024. Branded hotel openings

(HMI) Q2, 2024. comprised 50 hotels with 3,755 keys, of which 90% of the

Apart from a slight decrease in Goa’s average daily total number of keys were located in tier 2 and 3 cities,

rate (ADR), all other markets (Bengaluru, Chennai, Delhi, including Tirupati, Udaipur, Thane, and Mysore, to name

Hyderabad, and Mumbai) showed considerable growth a few.

in ADR and revenue per available room figures, with Hyderabad emerged as the RevPAR growth leader in Q2

2024 registering a growth of 11.9%

over Q2 2023, followed by Delhi and

Bengaluru with YoY growth of 11.8%

and 10.4% respectively.

“Backed by strong performance of

hotels across India, we continue to see

investors moving money in this asset

class. There is strong momentum on

both greenfield developments as well

as operating assets across business and

leisure markets. Although the summer

season has brought down corporate

room night demand in Q2 2024, the

sector continued to demonstrate

growth in average daily rates (ADR)

compared to Q2 2023. Looking

ahead, the sector’s performance in the

upcoming quarters appears promising

due to the upcoming festival season,

general rise in domestic corporate

travel, the return of MICE events,

weddings, and other social gatherings”,

said Jaideep Dang, Managing Director,

Hotels and Hospitality Group, India,

Source: STR JLL n

WWW.HOSPITALITYBIZINDIA.COM