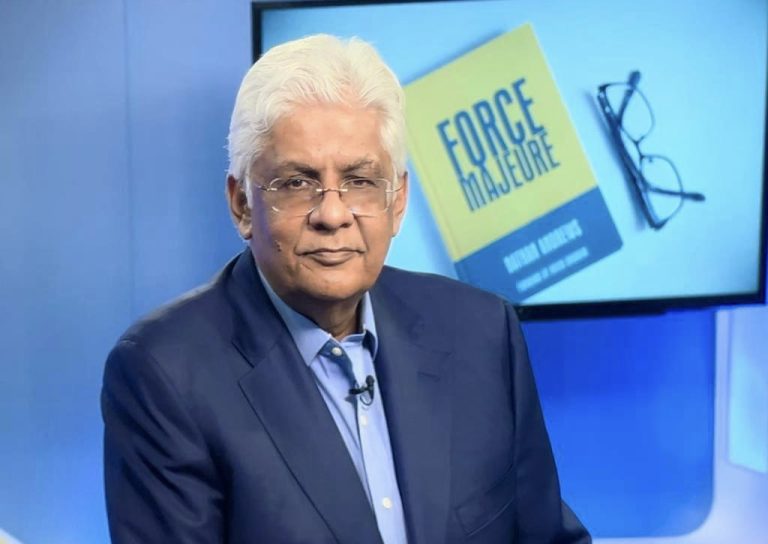

By Nathan Andrews, Author & Hospitality Consultant

Just this past week SAMHI announced the acquisition of Inmar Tourism for 205 crores. The asset that underlies this purchase is a 142-room hotel with an annual turnover of 24.76 crore. The news report also mentioned that a further 200-220 rooms may be constructed on the site, which I can safely assume was a key consideration in the final valuation.

Bottom line transactions are happening, and for transactions to happen there needs to be both a buyer and seller. In my current role, I receive on an average eight to ten opportunities a week, a mix of greenfield, brownfield and operating assets, so is it a good time to invest? And if so where and what? Perhaps to paraphrase Simon Sinek, the real question should be ‘ why’?

Obviously, there is no straightforward answer as there are a number of factors beyond the even the price. A wise king once said about the market ‘“It’s no good, it’s no good!” says the buyer- then goes off and boasts about the purchase.’, that remains as true today.

So, why invest and what makes for a good investment? I would say any investment that aligns with the buyer’s goals. Is the acquisition a strategic investment as part of a portfolio? Then a good investment will align with the long-term strategy and the portfolio mix. Is the investment long-term? Then greenfield assets may make more sense, if medium-term then operating or brownfield assets would be perhaps more attractive.

For me one of the key factors after knowing the why, and assessing the what is the replacement value. While the current market supports values of 12 – 14 times EBITDA and may be favourable to the seller, those levels do not leave anything on the table for the buyer particularly if the investment horizon of the buyer is less than eight to ten years. However, if the EBITDA multiples are close to the replacement value and the underlying land value if applicable is reasonable, then I believe that makes for a good investment.

In short, there is no one-size-fits-all, as a hoarding in the Oberoi Delhi used to say one man’s poisson is another man’s poison! The wise man knows the difference.