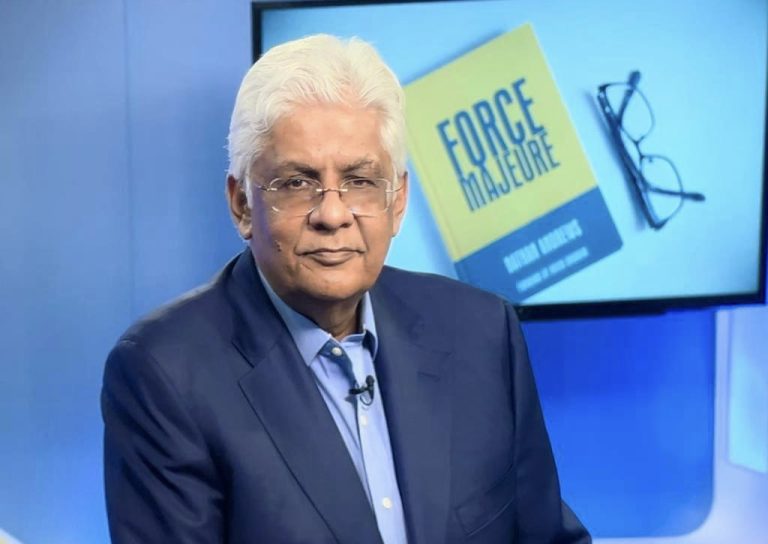

By Nathan Andrews, Author & Hospitality Consultant

These are good times for the hospitality industry? Right? I am sure, that if you are a part of any WhatsApp group, you would be on the receiving end of a never-ending stream of positive industry developments. Occupancy, rates, profitability, etc. are all at an all-time high, even allowing for much media hype. Which then begs the question as to why so many hospitality assets are at the same time in distress?

Behind the façade of success, lies, in many cases, a very different reality of unserviceable debt, punitive recovery action and the loss of the asset through asset reconstruction forums like the NCLT. How can both of these scenarios be true? The short answer is debt.

Admittedly every case has its own peculiarities and trigger points but at an underlying level the fundamental issue lies in the ability or inability to service the existing debt, and in this predicament, hospitality asset owners are not alone. The corporate landscape is littered with ghosts from the past, all of whom bit off more debt than they could chew. Robert Quillen, the American journalist, insightfully said, “Good times are when people make debts to pay in bad times”; repeated economic cycles have proved him correct.

Often, even at a personal level, we think of debt as a recourse to funding during difficult times. But if we look at the reality, the opposite is actually much truer. When we are in trouble, associates and institutions are much more likely to give us a wide berth than extend us a loan. However, when the going is good, the more the folks who come along to make a buck for themselves while ostensibly helping you to grow your wealth.

Think of it this way: You need a thousand rupees, who will you ask? Probably only a very close friend or family member, as the lender is likely to look askance at such a request. Make that ten lakhs and any number of loan offers are available. Raise that to crores and the lenders will probably chase you to accept their loan offer. The same is true at the corporate level. Make the ask big enough and even the Chairman of the Bank will come to you, and this when the going is good, or philosophically when the sun is shining. The problem is that the sun does not shine forever, and once the rain starts, the same financial institution who so kindly offered an umbrella when the sun was shining, asks for it back when the rain starts, leaving the borrower proverbially out in the rain.

So where does the fault lie? Are the lenders wrong in asking for repayment? Absolutely not! That is their business and the terms of corporate lending are usually quite clear and precise. Do they sometimes get skittish? Undoubtedly so, and usually at the most inopportune moment from the borrower’s perspective. But that is the nature of the beast, and if the fine print was read, to begin with, the relevant clauses would no doubt be already articulated.

The real issue is I would posit, to continue the analogy of the shining sun, is that neither party borrower or lender in many cases really planned for the rain. There is an underlying assumption that the good times will not only continue to roll but that the most optimistic projections will materialize. Particular to the hospitality industry, many of the distressed assets reflect loans that were in reality, even with the best of times, simply quite unserviceable. One has to wonder what Excel sheet was presented by the borrower and accepted by the lender that justified the quantum of debt and debt servicing ratios. Even without the worst of times, without unforeseen disruptors like COVID, managing the debt taken seems nigh impossible, with years like 2020 and 2021, implosion becomes a certainty.

Which begs a further question: Are these failures genuine mistakes of poor planning or failures by design? King David, the second king of Israel, wrote three thousand years ago, “the wicked borrow and do not repay”. Nothing much has changed in the past three millennia. A closer look at many of the distressed assets will evince a planned intent to misapply the funds, then default on the repayment, and finally negotiate a settlement where the lender takes a ‘hair-cut’ and everyone, except the lender’s stakeholders, live happily ever after. Fortunately, or unfortunately, things did not work out as planned, leaving both the borrower and the lender in a pickle.

Which brings us to where we are today. Amid all the genuine good news and industry positivity, there is much stress behind the scenes. Let us not forget the words of Charles Dickens which still ring true: “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity..” A tale of two cities or two realities?