ITC shareholders approved the company’s plan to spin off its hotels business on Thursday, following recommendations from key proxy advisors.

Approximately 99.6% of minority shareholders voted in favor of the move, surpassing the required three-fourths majority. The company’s shares closed 1.2% higher after the vote, having risen 1% earlier in the session.

Proxy advisory firms Stakeholders Empowerment Services (SES) and InGovern Research Services had recommended supporting the demerger, while Institutional Investor Advisory Services (IiAS) opposed it. IiAS called for greater clarity on the expected synergies from ITC maintaining a 40% stake in the new ITC Hotels entity, with shareholders holding the remaining stake.

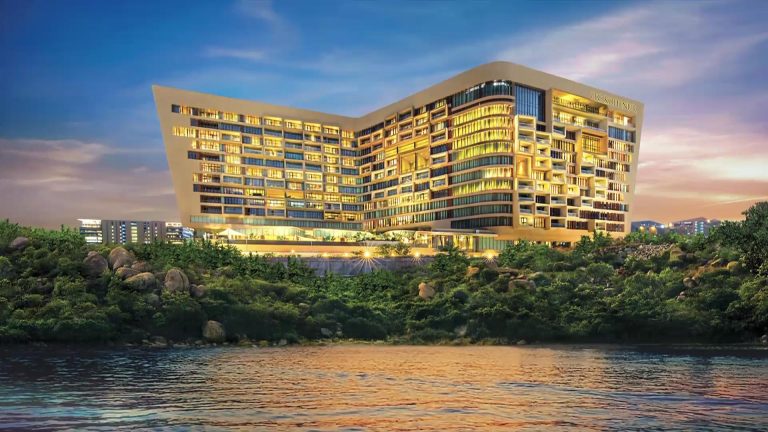

Known for its Goldflake cigarettes, ITC announced the demerger plan in July last year and expects to list the new entity within 15 months. ITC Hotels will compete independently with rivals such as Tata-owned Indian Hotels Company (Taj Hotels) and EIH Associated Hotels (Oberoi Hotels).

The hotels business contributed 4% to ITC’s revenue in fiscal year 2024, while the consumer staples segment accounted for 71%.

Source Business Standard