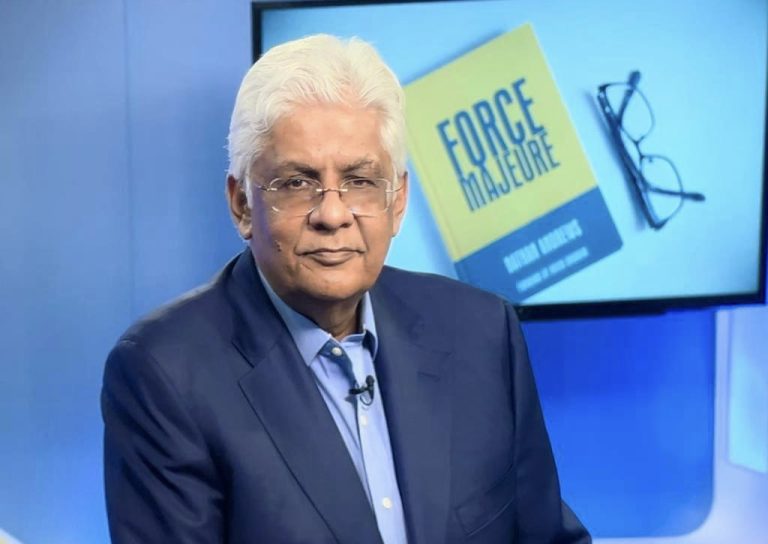

By Nathan Andrews, Author & Hospitality Consultant

Years back, when I had the privilege of setting up the first Ecole Hotelier Lausanne EHL campus in India, I remember the then CEO Yateendra Sinh saying that what set EHL apart from other hospitality institutes in the world was that they gave equal emphasis to the ‘art’ and ‘science’ of hospitality. What he meant was that historically European and Indian educational institutions had focused on the ‘art’ aspect, training students to deliver a great customer experience, be it through the rooms or through food and beverage, both production and/or service; while ignoring the ‘science’ of hospitality, the equally important business elements of marketing, finance and human resources. The American colleges on the other were very strong on the ‘science’ part, but paid little attention to the ‘art’.

While EHL was absolutely correct in the need to incorporate and balance both aspects, I believe there is a third element that has been completely missing from most training and development programs, which is the ‘math’ of hospitality. What do I mean by this?

In a nutshell, I am talking about Return on Investment ROI, Return on Investment to the owner of the property. The hospitality industry is largely a micro-focused business, focusing on the finer details to ensure customer delight. Consequently, the first years of any aspiring manager are focused on ensuring this last-mile service delivery and if they do this well, they find themselves entrusted with a hotel to manage independently. Here is where the missing elements of science and math become critical.

From a micro focus, the GM is now suddenly expected to make and deliver annual budgets, maintain a healthy GOP, capture market share and keep the owner of the asset happy. Most stumble at this stage, ending up sadly as ‘Maître d’s in the General Manager’s office and wondering why the ask from them has suddenly changed. Great at delivering customer satisfaction, they now have unhappy owners and management companies complaining about poor ROI breathing down their necks and are bewildered because no one told them about the math of hospitality.

The math is much more than just a healthy GOP, the math goes below the line beyond the NOP, EBIDTA to the PAT, which is the final return to the owner who has invested in the development of the hotel. Quite often by this stage, there is nothing much left for the investor after accounting for management fees, depreciation and tax; the owner is disgruntled, starts looking at the business as an underperforming asset and takes out his or her frustration on the hapless General Manager.

All this could be avoided if all parties involved understood the third element, i.e. the math. The ‘math’ is not just good financial structuring and tax planning, the math is the real estate element of our industry. My own learning in this regard came from one of my former bosses Mr. Unmesh Joshi CMD of the Kohinoor Group. At that time, I was heading his real estate business, but he mentioned once that at the end of the day, he looked at all his businesses which included hotels, education and the real estate business through a real estate lens. Were they delivering an equivalent or better return than the real estate opportunity cost?

A hotel is at a fundamental level a piece of real estate, there is cost of land, cost of development and cost of finance. The returns by nature are slow in comparison to other real estate asset classes where the investment cycle can be much faster sometimes even under five years, however at some point definite point in the foreseeable future, in my opinion, a maximum of eight years the investor must be able to see a positive return on their investment which includes their holding cost for the interim period.

Management companies and their General Managers need to understand this. Too often the investment required by the brand bears no relation to the actual ROI. The pitch to the investor is more emotional, or ego-driven backed up by unrealistic terminal values that make the projections look positive. The sad reality is that the real ‘math’ soon raises its head and the bragging rights of an inordinately expensive asset soon wear off, giving way to dissatisfaction at best and unserviceable debt at worst. Without the resources and the patience to wait for that elusive terminal value, the owner throws in the towel, is unable to reinvest in the maintenance of the property and a vicious downward spiral begins detrimental to all concerned.

‘Art’ and ‘science’ are indispensable to our industry but the ‘math’ is equally critical, if the business has to add up!